In the unexpectedly evolving panorama of finance, cryptocurrencies have emerged as a transformative pressure. While the era underpinning cryptocurrencies is remarkably new, the standards of change, price, and believe that they embody have deep ancient roots. This post delves into the exciting connections between cryptocurrencies and historical economic structures, exploring how the fundamental standards of digital currencies echo practices from millennia ago. For more in-depth information and details about cryptocurrencies, visit coinwiki, a comprehensive resource on digital currencies and blockchain technology.

The Rise of Cryptocurrencies

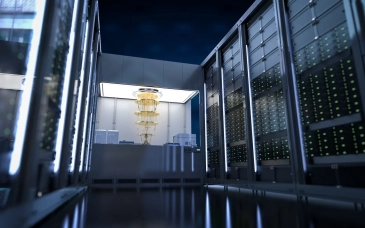

Cryptocurrencies are virtual or digital currencies that use cryptographic strategies for steady economic transactions. Unlike traditional currencies issued by governments (fiat money), cryptocurrencies function on decentralized networks based on blockchain era. This era ensures transparency, safety, and resistance to tampering, creating a new paradigm in economic transactions.

The first and maximum famous cryptocurrency, Bitcoin, become delivered in 2009 with the aid of an character or group underneath the pseudonym Satoshi Nakamoto. Bitcoin's underlying blockchain generation lets in it to characteristic as a decentralized ledger of transactions, casting off the need for a central authority, along with a bank. Since then, heaps of cryptocurrencies have emerged, each with particular features and use instances, from Ethereum’s clever contracts to Ripple’s awareness on go-border payments.

Historical Parallels: Ancient Systems of Exchange

To apprehend the importance of cryptocurrencies, it’s helpful to attract parallels with historic systems of exchange and cash. Many of the standards fundamental to cryptocurrencies may be traced again to historical practices and innovations:

- Barter Systems and the Emergence of Money:

Before the appearance of formal currencies, historic civilizations relied on barter structures to exchange goods and services. While barter allowed for direct change, it had good sized barriers, such as the "double accident of desires"—both events needed to want what the other provided. This inefficiency brought about the improvement of cash as a greater bendy and efficient medium of alternate. - The Origins of Coinage:

The idea of standardized money emerged round 600 BCE in Lydia (contemporary-day Turkey). The Lydians are credited with minting the first cash, made from electrum—a natural alloy of gold and silver. These cash had been stamped with reputable seals to verify their authenticity and fee, an early shape of making sure accept as true with in monetary transactions. This exercise mirrors the cryptographic verification mechanisms used in modern-day cryptocurrencies, wherein every transaction is established and recorded in a public ledger. - Paper Money and the Birth of Banking:

Paper cash first appeared in China in the course of the Tang Dynasty (618–907 CE) and have become extra sizeable all through the Song Dynasty (960–1279 CE). The use of paper currency became a giant advancement over steel cash, bearing in mind easier and more bendy transactions. Additionally, historic Chinese traders developed early types of banking and credit systems, laying the basis for the economic infrastructure that cryptocurrencies seek to innovate upon. - The Role of Trust in Transactions:

The fulfillment of ancient currencies and monetary systems depended heavily on trust. In Rome, as an example, the sizeable use of cash required a system of consider in the country’s potential to again the forex’s value. This principle of consider is similar to how cryptocurrencies depend on blockchain era to make certain the integrity and safety of transactions, notwithstanding the absence of a central authority.

The Evolution of Financial Systems

Throughout history, monetary structures have constantly developed to meet the wishes of converting economies. From the advent of coinage to the development of virtual banking, each innovation has aimed to enhance the performance, safety, and accessibility of financial transactions. Cryptocurrencies constitute the today's evolution in this lengthy records, combining technological improvements with undying ideas of believe and value.

- From Physical to Digital:

The transition from bodily coins and paper cash to digital currencies displays broader trends in technology and globalization. As societies an increasing number of pass closer to virtual platforms for verbal exchange and commerce, the upward thrust of virtual currencies is a herbal progression. Just as paper cash changed cash and electronic banking replaced bodily banknotes, cryptocurrencies are poised to play a imperative role in the destiny of finance. - The Democratization of Finance:

One of the maximum compelling factors of cryptocurrencies is their capacity to democratize finance. Traditional monetary systems have frequently been criticized for his or her exclusivity and the barriers they impose on get right of entry to to economic offerings. Cryptocurrencies offer a decentralized alternative that allows people global to take part inside the worldwide financial system, irrespective of their vicinity or socioeconomic fame.

Challenges and Opportunities

Despite their capacity, cryptocurrencies face severa challenges, which includes regulatory hurdles, safety worries, and marketplace volatility. However, these challenges also gift opportunities for innovation and improvement. The lessons found out from historical economic structures can inform the improvement of extra robust and inclusive digital currencies, making sure that they are able to satisfy their promise of transforming worldwide finance.

- Regulation and Governance:

Just as historical societies evolved systems of governance to manage and regulate their currencies, present day cryptocurrencies require frameworks to address legal and regulatory issues. Balancing innovation with law can be crucial in ensuring the long-term stability and popularity of digital currencies. - Security and Trust:

Security stays a essential difficulty inside the international of cryptocurrencies. The early believe positioned in physical cash and banking systems can be paralleled with the need for sturdy security measures in virtual transactions. Advances in cryptographic techniques and blockchain generation maintain to enhance the safety of cryptocurrencies, building at the ancient foundation of agree with in financial structures.

Cryptocurrencies represent a profound shift in how we recognize and manage cash, but their principles are deeply rooted inside the history of finance. By analyzing the evolution of monetary structures from historic coinage to modern virtual currencies, we are able to admire the continuity and alternate inside the approaches societies deal with value and trade.

As we navigate this new frontier, it’s captivating to mirror on how ancient practices and innovations maintain to form our financial systems. The enduring quest for efficient, stable, and straightforward manner of transaction connects us with our historic predecessors, highlighting the undying nature of economic trade and the ever-evolving nature of human ingenuity.